What are ticker symbols?

A ticker symbol is a unique symbol that is given to a product when it’s traded on the exchange. Sometimes, the ticker symbol can also be called the future contract symbol, futures symbol, or trading symbol, but all terms refer to similar ideas.

Apart from the symbol, most ticker symbols are added with a symbol to represent the contract month or year. The letters representing the months are F=Jan, G=Feb, H-Mar, J=Apr, K=May, M=June, N=July, Q=Aug, U=Sep, V=Oct, X=Nov, Z=Dec. The last number at the end of the contract is the year.

To provide easier access to the symbols for the QFI-approved products, the following infographics will contain the ticker symbols for Shanghai Futures Exchange, Shanghai International Energy Exchange, Dalian Commodity Exchange, Zhengzhou Commodity Exchange, and China Financial Futures Exchange.

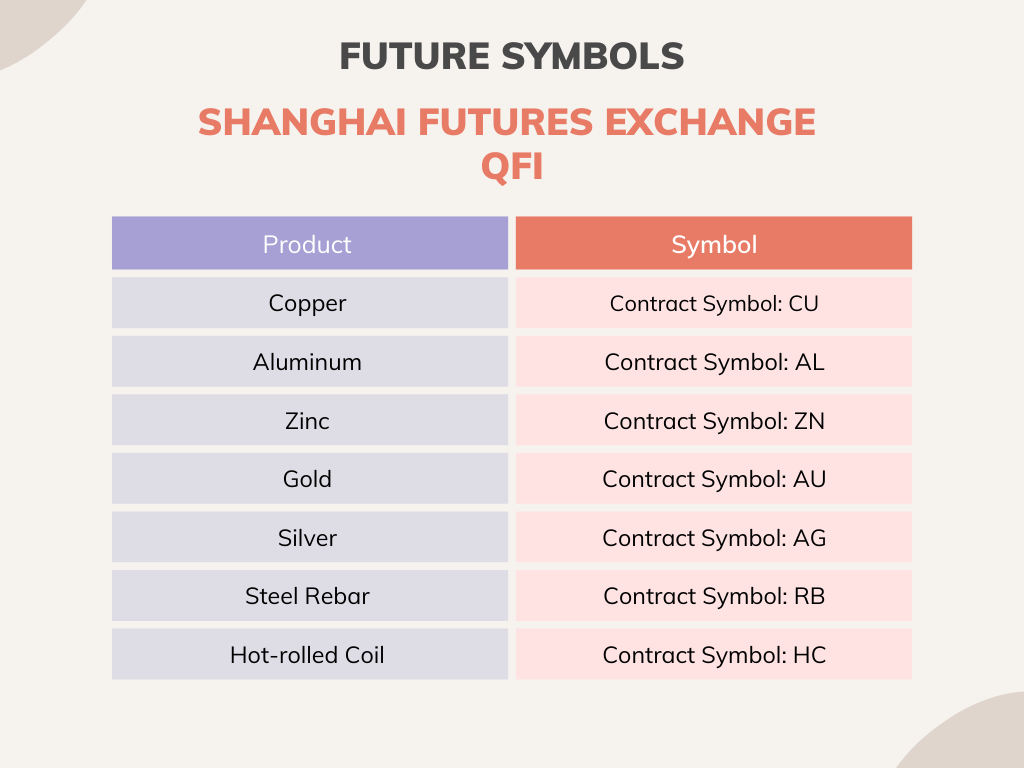

Shanghai Futures Exchange

Shanghai Futures Exchange offers 7 QFI-approved futures products which are, copper, aluminum, zinc, gold, silver, steel rebar, and hot-rolled coil, however, the exchange has a total of 16 products in total, mostly in the forms of ferrous and non-ferrous metals, except for fuel oil, Bitumen, Natural Rubber, and Wood pulp.

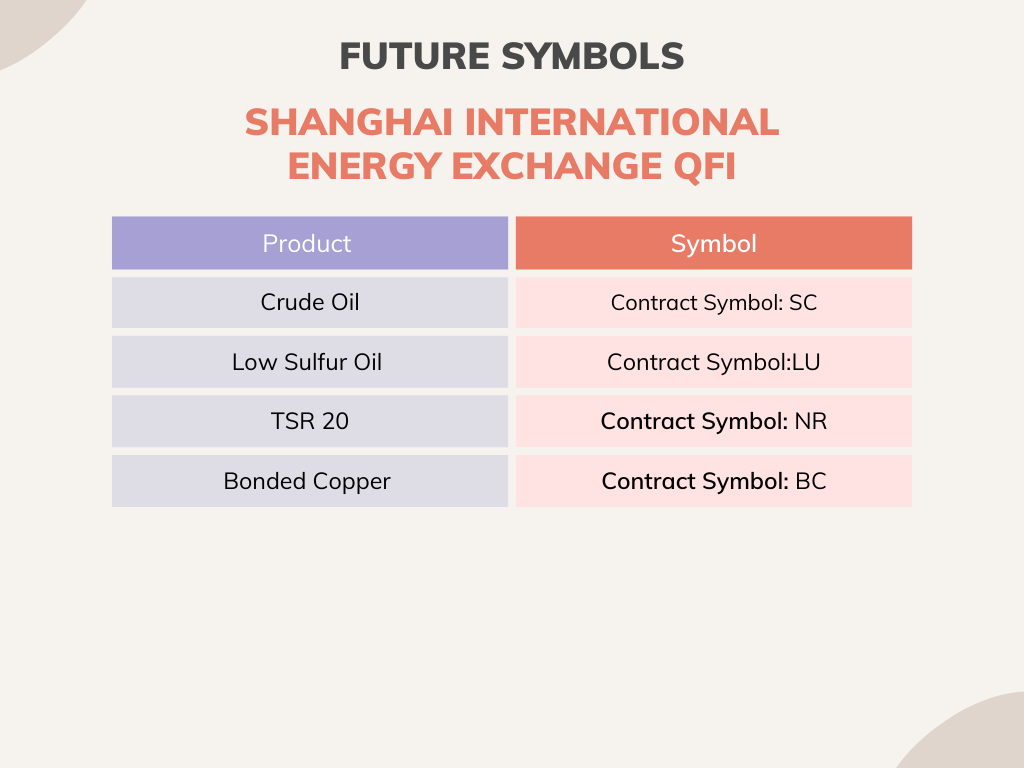

Shanghai International Energy Exchange

Shanghai International Energy Exchange offers 4 QFI-approved products which are crude oil, low sulfur fuel oil, TSR 20, and bonded copper.

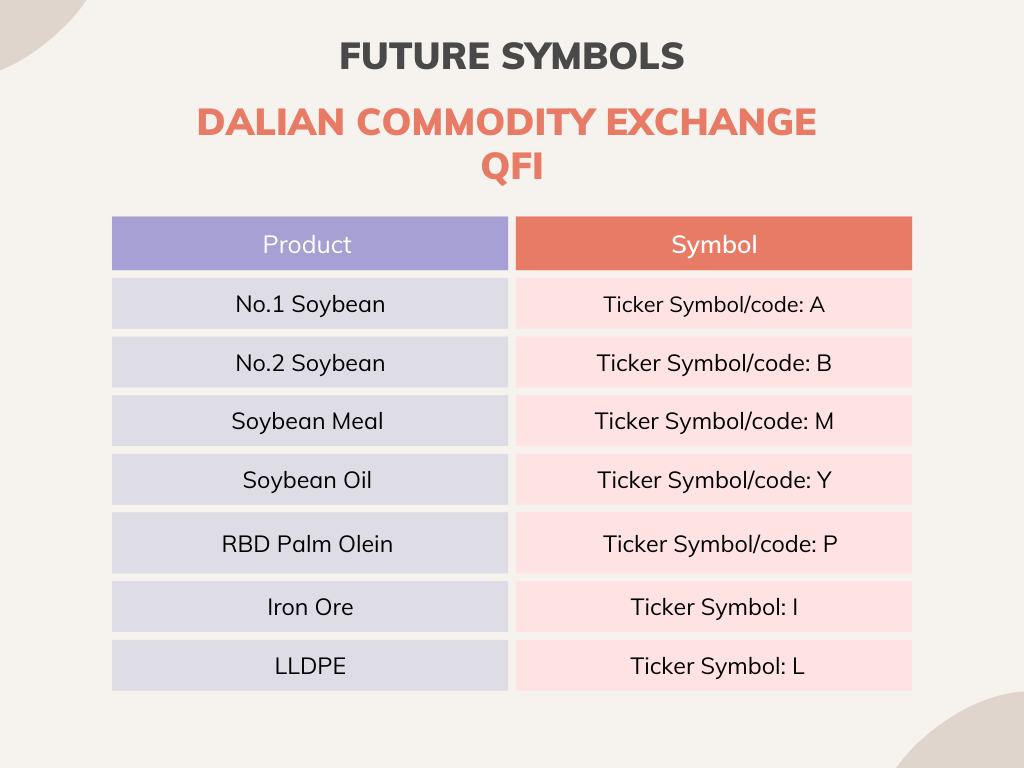

Dalian Commodity Exchange

Dalian Commodity Exchange offers 7 QFI Approved products which are No.1 Soybean, No.2 Soybean, Soybean Meal, Soybean Oil, RBD Palm Olein, Iron Ore, and LLDPE. However, in total, DCE offers 21 products that vary from agricultural commodities to raw materials. On December 2022, soybean has also been launched as an internationalised product.

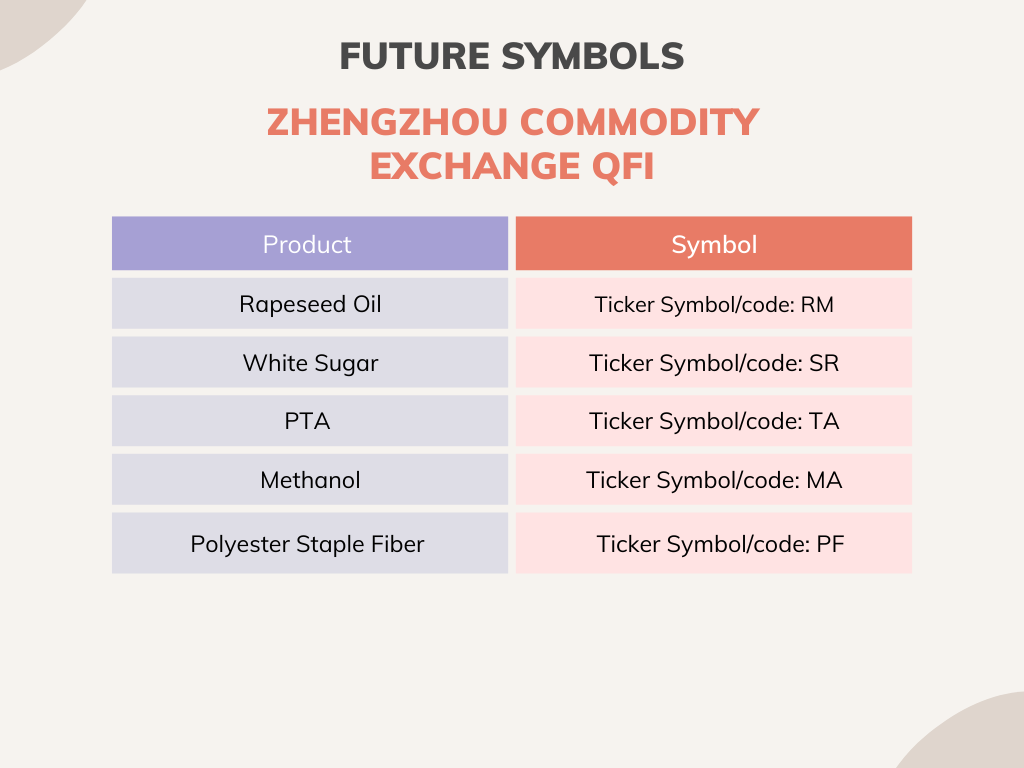

Zhengzhou Commodity Exchange

Zhengzhou Commodity Exchange offers 5 QFI-approved products which are rapeseed oil, white sugar, PTA, Methanol, and polyester staple fiber. Other products in the exchange are mostly agricultural commodities and some raw materials. On January 2023, Rapeseed products as well as Peanut Kernels were launched as internationlised products.

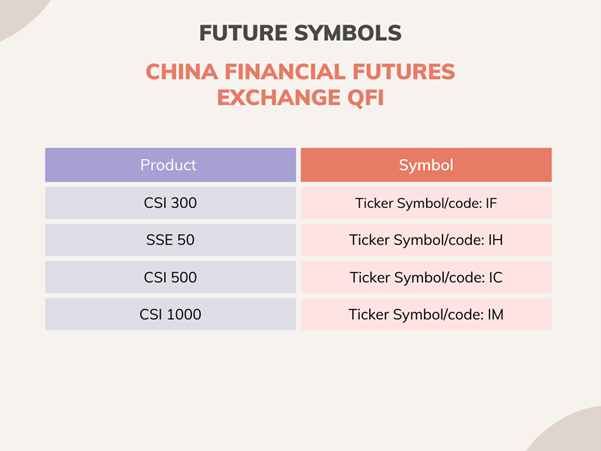

CFFEX Exchange

China Financial Futures Exchange (CFFEX) is the only exchange that offers a hedge-only index for QFI trading, CSI 300, SSE 50, CSI 500, and CSI 1000. The exchange also has other products such as 2-year treasury bonds, 5-year treasury bonds, and 10-year treasury bonds that are not released to international traders as of date.

Start Trading with Orient Futures Singapore

Being an Overseas Intermediary of Shanghai International Energy Exchange (INE), Dalian Commodity Exchange (DCE), and Zhengzhou Commodity Exchange (ZCE), when foreign clients participate in internationalised futures contracts in these Chinese markets with us, they have direct access to trading, clearing, and settlement. Our parent company, Shanghai Orient Futures, is the largest broker in terms of aggregated volume across the five regulated exchanges in China.

Orient Futures Singapore also currently holds memberships at the Singapore Exchange (SGX), Asia Pacific Exchange (APEX), and ICE Futures Singapore (ICE SG). Starting August 2023, corporate clients can also gain access to the B3 Exchange through us, opening additional trading avenues.

Expect streamlined processes and an easy-to-use interface designed for minimal latency, accompanied by our team’s round-the-clock availability on trading days to provide assistance for all your trading needs.